The Smarter Way to Manage Your Money

IB Universal Account

The Smarter Way to Manage Your Money

Unlock Your Financial Potential with an All-in-One Solution

Manage all your finances in one account!

Earn Interest

Earn interest up to USD 3.83% on instantly available cash balances1

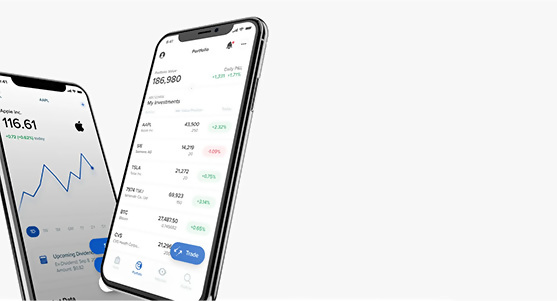

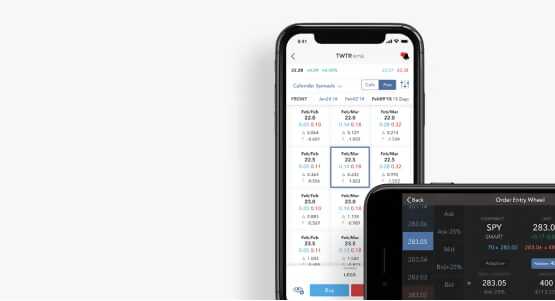

View Interest DetailsIBKR Mobile

Check Deposit

Depositing funds to your IBKR account is now as easy as taking a picture with the IBKR Mobile app.

Learn About Mobile DepositsBank Deposit Sweep Program

Our Insured Bank Deposit Sweep Program allows eligible IBKR clients to obtain up to $5,000,000 of FDIC insurance in addition to existing $250,000 SIPC coverage for total coverage of $5,250,000.

Learn About Sweep ProgramDirect Deposit

Automatically deposit funds denominated in USD from your financial institution to your IBKR account.

Learn About Direct DepositStrength & Security

IBKR is a broker you can trust, and our strong financial position and conservative business management protect IBKR and our clients.

Our Strength and SecurityOpen Your Account Today!

Download an app and sign up, or sign up online

Disclosures

- Restrictions apply. For additional information on interest rates, click here. Credit interest rate as of July 7, 2025 .

- For complete information, see ibkr.com/compare.